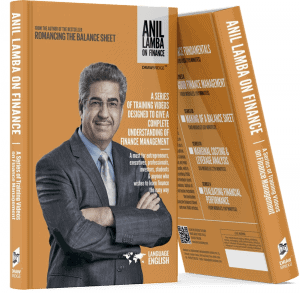

Anil Lamba On Finance – Complete Video Set of 18 Modules

Since Bad Finance Management is the single most important cause of business closure, it is essential for every organization to practice Good Finance Management in order to survive and prosper. In this session Dr Lamba explains that Good Finance Management is the collective responsibility of each person in the organization and gives a brief introduction of the two rules.

₹51,300

All the series and modules by Dr. Anil Lamba bundled into a single course.

Series 1 – Finance Fundamentals

The 2 modules in this series are intended to lay a strong foundation for understanding the financial principles discussed in subsequent sessions. Using easy to understand jargon-free language, Dr. Lamba introduces the two most important financial statements & eliminates a number of misconceptions usually associated with commonly-used-yet-often-misinterpreted terms.

Module 1 – Understanding Financial Statements

In this session Dr Lamba introduces the P/L A/c and B/S explains how to make these statements with the help of a three-minute formula demystifies the two dreaded words, Debit and Credit, that create confusion in the minds of many and discusses the similarity and distinction between terms like Expenses, Assets, Incomes and Liabilities.

Module 2 – What is Profit?

Every business is run with the objective of making profit. However the term itself is often misconstrued. In this session Dr Lamba explains the ‘concept of profit’, and takes a philosophical look at the role of ‘Expenses’ and the part played by ‘Inventory’ in arriving at, and sometimes manipulating, profit.

Series 2 – Good Finance Management

Financial mismanagement is responsible for most business failures the world over. Even the global economic meltdown towards the end of the first decade of this millenium is primarily attributed to financially disastrous decisions. In this series, Dr. Lamba gives his mantra of Good Finance Management & expounds on his two golden rules. Organisations that abide by these rules achieve sustained growth & success & those that violate them can suffer serious consequences.

Module 1 – A Closer Look at the Balance Sheet

This module takes a closer look at the structure of a Balance Sheet and discusses the various items in detail, explains how Liabilities represent ‘Sources’ and Assets ‘Uses’, how organizations raise resources and the expectation of each lender, where the money is invested, the need for working capital and its components.

Module 2 – Two Rules of Good Finance Management. An Overview

Since Bad Finance Management is the single most important cause of business closure, it is essential for every organization to practice Good Finance Management in order to survive and prosper. In this session Dr Lamba explains that Good Finance Management is the collective responsibility of each person in the organization and gives a brief introduction of the two rules.

Module 3 – Rule One of Good Finance Management : Managing Profitability

Dr Lamba explains the concept of Cost of Capital, explodes certain myths associated with the term, and emphasizes how it is critical to ensure that organizations generate returns that are at least equal to the Weighted Average Cost of Capital.

Module 4 – Rule Two of Good Finance Management : Managing Cash Flow

In this module, besides elaborating on the second rule of good finance management, which revolves around effective cash flow management, Dr Lamba also explains how to read a Balance Sheet.

Series 3 – Making of a Balance Sheet

The usual perception is that it takes years to learn how to make Profit & Loss Accounts and Balance Sheets. Dr. Lamba teaches, in a very quick & simple way, how to make these financial statements in both the accountant’s, as well as the layperson’s way.

Module 1 – Making a Balance Sheet Without any Knowledge of Accounting

Ever felt the need to make a Profit and Loss Account and Balance Sheet, but found yourself at a loss as to how to proceed? In this module Dr Lamba will show you the easiest and most logical way to prepare these statements without even an elementary knowledge of accounting.

Module 2 – Making a Balance Sheet The Accountant’s Way

In this module Dr Lamba explains the intricacies involved in the making of the two basic financial statements from an accountants’ perspective. Using an example, he illustrates how to pass journal entries, post them into ledger accounts, make a trial balance and eventually the Profit and Loss Account and Balance Sheet.

Series 4 – Marginal Costing and Leverage Analysis

Application of marginal costing principles is essential to take financially profitable decisions. In the 6 modules comprising this series, Dr. Lamba explains complicated marginal costing concepts in such an easy & interesting way that it will make you wish you had known about it earlier.

Module 1 – Trading on Equity

This module is actually an introduction to the principles of Marginal Costing. It begins with an example dramatically driving home the impact that the pattern of funding has on an organization’s profitability. Dr Lamba then emphasizes on the need for business leaders and key executives to possess the ability to understand a firm’s bottomline merely by knowing its topline, without waiting for accountants to give them this information. He then goes on discuss tools and techniques to do so.

Module 2 – Marginal Costing Break-even Analysis

In this module, using a case, Dr Lamba explains the key terms in marginal costing: Variable Cost, Fixed Cost and Contribution. He explains how to arrive at profit using marginal costing principles, how to calculate break-even points, how to work out the profit at any level of sales and the sales at any level of profit.

Module 3 – Cost-Volume-Profit Analysis

Marginal costing formulae are explained in this module. Dr Lamba explains how, many decisions, which are any how taken on a regular basis, become financially more intelligent if one starts applying marginal costing principles.

Module 4 – Marginal Costing – Cases I

In this module Dr Lamba explains, with the help of illustrations, how to apply marginal costing principles to take decisions pertaining to the period of credit that can be offered to customers, how to factor in the probability of bad debts associated with longer periods of credit, and whether or not one should accept customers that are guaranteed to go bad.

Module 5 – Marginal Costing – Cases II

Cases related to multi-product companies, make-or-buy decisions, how to use the four drivers of profit to improve the bottomline and calculating the break-even credit period that can be offered are discussed in this module.

Module 6 – Leverage Analysis

Leverages, in the context of finance management, denote a disproportionate impact on the bottomline due to a certain change in topline. Dr Lamba explains how fixed cost assets or funds can be used to magnify returns to owners, how to calculate the leverage multiple and how to use Leverage Analysis to gauge the risk profile of any entity.

Series 5 – Evaluating Financial Performance

In this series, two very important tools of evaluating financial statements, Ratio Analysis & Funds Flow Analysis, are explained.

Module 1 – Ratio Analysis

What are Ratios, their significance to interested parties and how to read them in conjunction with each other, form the basis of this video. Dr. Lamba explains at length the various ratios that need to be worked out in order to establish the profitability, stability and efficiency of an organization.

Module 2 – Ratio Analysis – Cases

Cases illustrating how to re-arrange financial data in a form suitable for ratio analysis, and also how to create financial statements with the help of ratios are covered in this module.

Module 3 – Funds Flow Analysis How to Make Funds Flow Statements

A Funds Flow Statement provides insights into the functioning of an organization, which may not be apparent from a reading of the Balance Sheet alone. Using a case, Dr Lamba explains how to interpret each figure and how financial statements can be made to look attractive, till studied in depth and relevant questions asked.

Module 4 – Funds Flow Analysis How to Read Funds Flow Statements

Every organization must prepare a Funds Flow Statement, in addition to the P/L A/c and the B/S . In this session Dr Lamba explains, using an example, the steps involved in the making of this statement. This module also covers the importance of footnotes to financial statements and how to use them in the preparation of a Funds Flow Statement.

About the Author

DR ANIL LAMBA is a bestselling author, financial literacy activist and international corporate trainer. A chartered accountant, holding degrees in commerce and law as well as a doctorate in taxation, his training programmes are held internationally, with a client list exceeding 2000 large- and medium-sized corporations spread across India, the US, Europe, the Middle-East and the Far-East.

He is the founder-director of Lamcon School of Management in Pune, India.

He has conceptualised, and is actively engaged in the implementation of, Financially Intelligent Organisation™, the first of its kind certification awarded by Lamcon to corporations for management accounting processes and financial acumen, and Financial Literacy for All™, an initiative aimed at providing financial literacy free of cost to a billion Indians.

Dr Lamba has written several books and over 1500 articles, and has done pioneering work in the fields of distance education and e-learning. He has created and developed two series of training videos: Figure Out the World of Figures™ and Anil Lamba on Finance.

Reviews

There are no reviews yet.