GOOD FINANCE MANAGEMENT

‘Anil Lamba on Finance’

is a series of training videos designed to provide a complete and comprehensive understanding of finance management irrespective of education background, expertise and job profile.

3 Hours

Actionable Content

3000+

Satisfied customers

4 Modules

Sequentially Planned

Anil Lamba on finance: good finance management

A good financial management system tells you how your business is doing and why.

It is a process that if used correctly, can put your numbers to work and place your business on an even steeper growth trajectory.

Since bad finance management is the single most important cause of business closure, it is essential for every organization to practice Good Finance Management in order to survive and prosper.

Each of the four sessions in this series is extremely powerful and important for every individual to understand, appreciate and implement in his/her organisation.

Details of the four modules of the series are as follows:

Module 1: A Closer Look at the Balance Sheet

This module takes a closer look at the structure of a Balance Sheet and discusses the various items in detail. Dr Lamba explains how Liabilities represent ‘Sources’ and Assets ‘Uses’; how organizations raise resources and the expectations of each lender; where the money is invested and; the need for working capital and its components.

Learnings:

– Know all about PBIT & EBIT

– Mantra for Good Finance Management

Module 2: Two Rules of Good Finance Management

There are two fundamental rules of Good Finance Management, which, if followed, can help organisations avoid a host of problems that result from financial mismanagement. These rules can be universally applied, irrespective of industry, and are explained in this module. Via this module, you will also learn that Good Finance Management is the collective responsibility of every person in the organization.

Learnings:

– What is Finance Management?

– Why do Businesses become sick?

Module 3: Rule 1 of Good Finance Management Managing Profitability

This module covers the concept of Cost of Capital, busts certain myths associated with the term, and emphasizes how critical it is to ensure that organizations generate returns that are at least equal to its Weighted Average Cost of Capital.

Learnings:

– Recognise the crime of holding on to Non-Performing Assests

Module 4: Rule 2 of Good Finance Management Managing Cash Flow

In this module, besides elaborating on the second rule of good finance management, which revolves around effective Cash Flow Management, you will also learn how to read the different types of Balance Sheets.

Learnings:

– What type of an organization would a bank prefer working with?

– Working Capital Cycle

– Know your Balance Sheets

Course Package includes:

4 Video Tutorials

Each video corresponds to one module of 1-2 hour duration

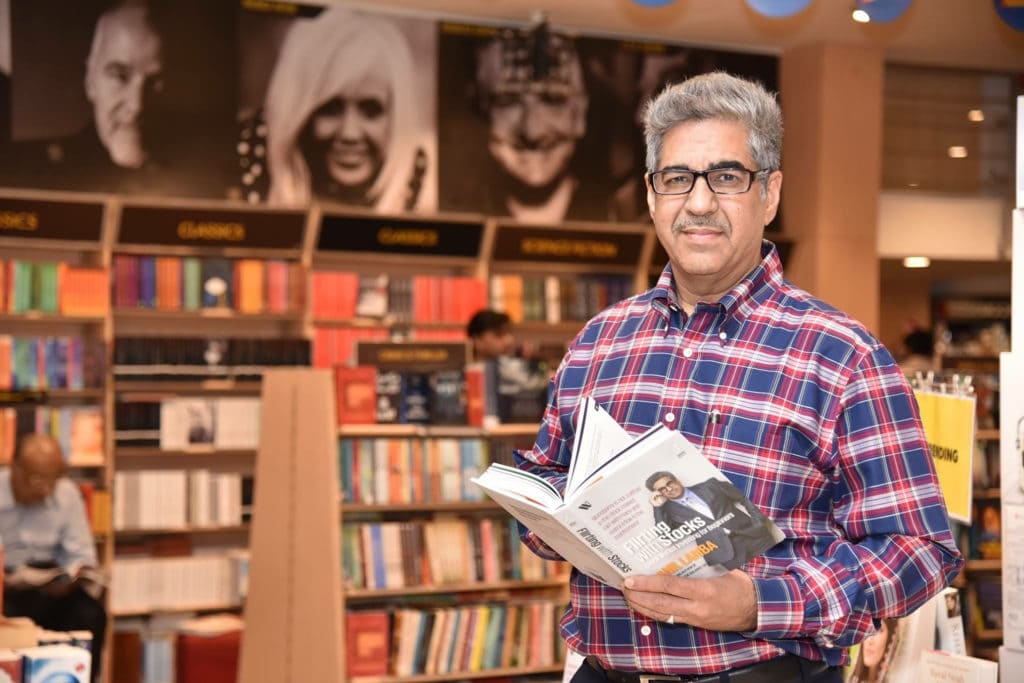

ABOUT

DR ANIL LAMBA

HOW IS THE COURSE STRUCTURED

- Each video corresponds to one module of 1-2 hour duration.

- You can view the videos as many times as you want. The validity period of these videos is for 45 Days from the date of enrollment.

- Videos are available in 2 versions - For both Low & High Bandwidths

- Video Language: English

- The videos cannot be downloaded