Anil Lamba on finance

This is a combo of 5 series of training videos designed to provide a complete and comprehensive understanding of finance management irrespective of education background, expertise and job profile.

14+ Hours

Actionable Content

3000+

Satisfied customers

18 Modules

Sequentially Planned

A Complete Set

Finance Fundamentals + Good Finance Management + Making Of A Balance Sheet+ Marginal Costing & Leverage Analysis + Evaluating Financial

A good financial management system tells you how your business is doing and why.

It is a process that if used correctly, can put your numbers to work and place your business on an even steeper growth trajectory.

Since bad finance management is the single most important cause of business closure, it is essential for every organization to practice Good Finance Management in order to survive and prosper.

Each of the 5 series in this combo is extremely powerful and important for every individual to understand, appreciate and implement in his/her organisation.

Details of 18 modules of the series are as follows:

Module 1: Understanding Financial Statements

In this session Dr Lamba introduces the P/L A/c and B/S explains how to make these statements with the help of a three-minute formula demystifies the two dreaded words, Debit and Credit, that create confusion in the minds of many and discusses the similarity and distinction between terms like Expenses, Assets, Incomes and Liabilities.

Module 2: What is Profit?

Every business is run with the objective of making profit. However the term itself is often misconstrued. In this session Dr Lamba explains the ‘concept of profit’, and takes a philosophical look at the role of ‘Expenses’ and the part played by ‘Inventory’ in arriving at, and sometimes manipulating, profit.

Module 3: A Closer Look at the Balance Sheet

This module takes a closer look at the structure of a Balance Sheet and discusses the various items in detail. Dr Lamba explains how Liabilities represent ‘Sources’ and Assets ‘Uses’; how organizations raise resources and the expectations of each lender; where the money is invested and; the need for working capital and its components.

Module 4: Two Rules of Good Finance Management

There are two fundamental rules of Good Finance Management, which, if followed, can help organisations avoid a host of problems that result from financial mismanagement. These rules can be universally applied, irrespective of industry, and are explained in this module. Via this module, you will also learn that Good Finance Management is the collective responsibility of every person in the organization.

Module 5: Rule 1 of Good Finance Management Managing Profitability

This module covers the concept of Cost of Capital, busts certain myths associated with the term, and emphasizes how critical it is to ensure that organizations generate returns that are at least equal to its Weighted Average Cost of Capital.

Module 6: Rule 2 of Good Finance Management Managing Cash Flow

In this module, besides elaborating on the second rule of good finance management, which revolves around effective Cash Flow Management, you will also learn how to read the different types of Balance Sheets.

Module 7: Making of a Balance Sheet-I

Module 8: Making of a Balance Sheet-II

Module 9: Trading on Equity

This module is actually an introduction to the principles of Marginal Costing. It begins with an example dramatically driving home the impact that the pattern of funding has on an organization’s profitability. Dr Lamba then emphasizes on the need for business leaders and key executives to possess the ability to understand a firm’s bottomline merely by knowing its topline, without waiting for accountants to give them this information. He then goes on discuss tools and techniques to do so.

Module 10: Marginal Costing Break-even Analysis

In this module, using a case, Dr Lamba explains the key terms in marginal costing: Variable Cost, Fixed Cost and Contribution. He explains how to arrive at profit using marginal costing principles, how to calculate break-even points, how to work out the profit at any level of sales and the sales at any level of profit.

Module 11: Cost-Volume-Profit Analysis

Marginal costing formulae are explained in this module. Dr Lamba explains how, many decisions, which are any how taken on a regular basis, become financially more intelligent if one starts applying marginal costing principles.

Module 12: Marginal Costing - Cases I

In this module Dr Lamba explains, with the help of illustrations, how to apply marginal costing principles to take decisions pertaining to the period of credit that can be offered to customers, how to factor in the probability of bad debts associated with longer periods of credit, and whether or not one should accept customers that are guaranteed to go bad.

Module 13: Marginal Costing - Cases lI

Cases related to multi-product companies, make-or-buy decisions, how to use the four drivers of profit to improve the bottomline and calculating the break-even credit period that can be offered are discussed in this module.

Module 14: Leverage Analysis

Leverages, in the context of finance management, denote a disproportionate impact on the bottomline due to a certain change in topline. Dr Lamba explains how fixed cost assets or funds can be used to magnify returns to owners, how to calculate the leverage multiple and how to use Leverage Analysis to gauge the risk profile of any entity.

Module 15: Ratio Analysis

What are Ratios, their significance to interested parties and how to read them in conjunction with each other, form the basis of this video. Dr. Lamba explains at length the various ratios that need to be worked out in order to establish the profitability, stability and efficiency of an organization.

Module 16: Ratio Analysis Cases

Cases illustrating how to re-arrange financial data in a form suitable for ratio analysis, and also how to create financial statements with the help of ratios are covered in this module.

Module 17: Funds Flow Analysis - How to Read

A Funds Flow Statement provides insights into the functioning of an organization, which may not be apparent from a reading of the Balance Sheet alone. Using a case, Dr Lamba explains how to interpret each figure and how financial statements can be made to look attractive, till studied in depth and relevant questions asked.

Module 18: Funds Flow Analysis - How to Make

Every organization must prepare a Funds Flow Statement, in addition to the P/L A/c and the B/S. In this session Dr Lamba explains, using an example, the steps involved in the making of this statement. This module also covers the importance of footnotes to financial statements and how to use them in the preparation of a Funds Flow Statement.

Course Package includes:

18 Video Tutorials of over 14+ hours

Each video corresponds to one module of 20-70 minutes duration

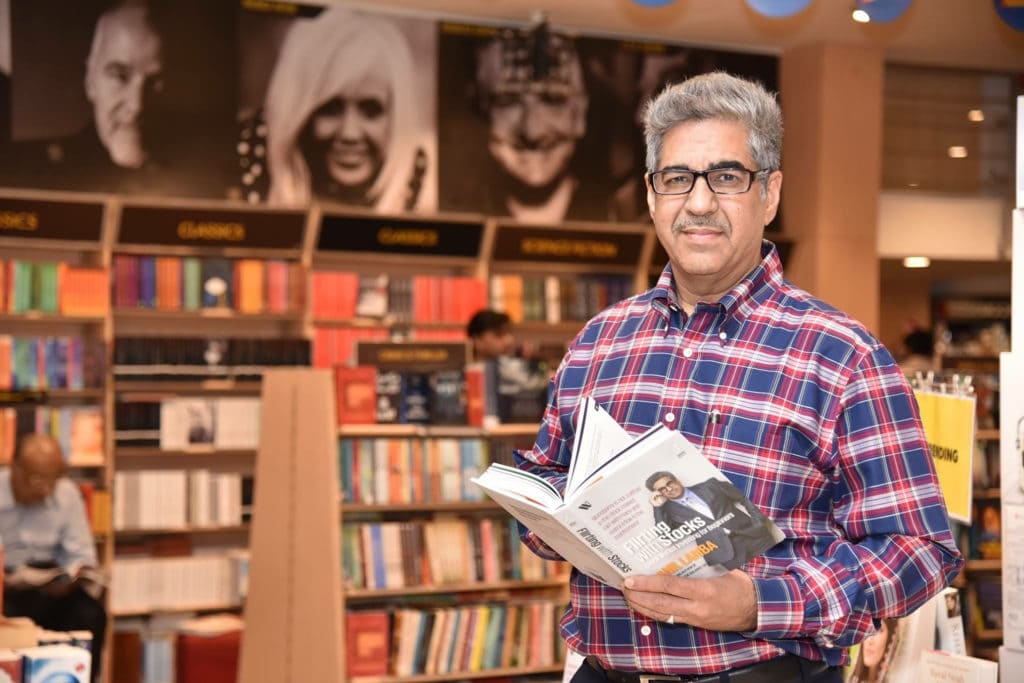

ABOUT

DR ANIL LAMBA

Dr Anil Lamba’s training programs are held internationally, with a client list exceeding 3000 large and medium sized corporations spread across several countries including India, the USA, and in Europe, the Middle-East and the Far-East.

He has also written several books and over one thousand articles. His latest book, ‘Romancing the Balance Sheet’ is currently making waves.

HOW IS THE COURSE STRUCTURED

- Each video corresponds to one module of 20-70 minutes duration.

- You can view the videos as many times as you want. The validity period of these videos is for 90 Days from the date of enrollment.

- Videos are available in 2 versions - For both Low & High Bandwidths

- Video Language: English

- The videos cannot be downloaded